[ad_1]

1 / 7

1 / 7The US economy is likely to enter a recession in the second half of 2025, according to 60% of all the chief financial officers surveyed by CNBC. This is a sharp increase from the 7% in the last survey held in the last quarter of 2024. Another 15% projected a recession in the world’s largest economy in 2026.

2 / 7

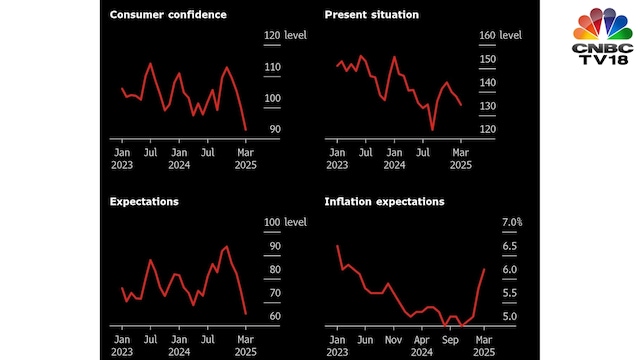

2 / 7Not just CFOs, even the average consumers in the US are now fearing the worst. The proportion of US consumers expecting a recession is now at a 9-month high, according to Bloomberg. Data showed on March 25, that the US consumer confidence in the current situation was the lowest in over 4 years, and the confidence in the situation over the next six months has never been this bad in the last 12 years. Charts sourced from Bloomberg.

3 / 7

3 / 7On March 10, Harvard University economist Kenneth Rogoff told CNBC-TV18 that there’s a 30-35% of a US recession in 2025, largely due to unpredictability of Trump’s economic policy, government spending cuts, and the impact of tariffs likely to be imposed on April 2.

4 / 7

4 / 7Bond market expert Jeffrey Gundlach from DoubleLine Capital pegged the probability of a US recession in 2025 between 50% and 60%. A Deutsche Bank survey showed a 43% chance of US recession in the next 12 months.

5 / 7

5 / 7The CFOs surveyed by CNBC described their mood as ‘pessimistic’. 95% of them said the uncertainty caused the disruptive moves of the Donald Trump administration has affected their ability to make decisions.

6 / 7

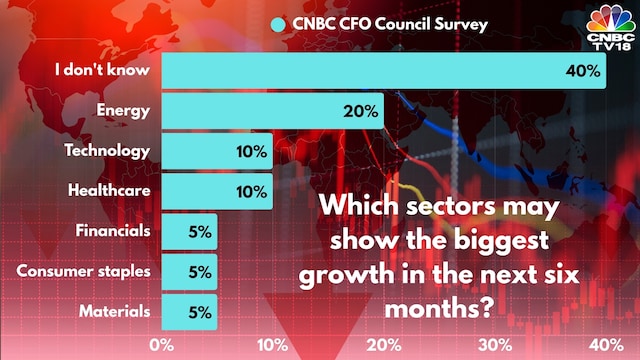

6 / 740% of the CFOs didn’t hazard a guess on which sector (within the stock market) is likely to show the biggest growth in the next six months. 90% of those surveyed said Dow Jones, the benchmark stock index, will test 40,000 this year. That’s 6% below the last closing level on March 25. At the end of last week, the US stock market had seen over $5.5 trillion wiped off from its value in the preceding month led by a sell-off, largely, in big tech stocks like Tesla, Nvidia, Salesforce, Apple, and Google’s parent Alphabet, among others.

7 / 7

7 / 7Here’s a contrarian view. “I don’t think we are on the cusp of a recession like environment, but that huge uncertainty is a marker for likelihood of postponing investments. That is bad for the medium-term growth outlook. It is also a marker for maybe some large-scale consumption that get postponed. Having said that, if you look at home sales numbers of the last two months, it’s not that bad. Interest rates have come down a bit. There are certain parts of the US, Washington DC would be one example where there is significant amount of paralysis in the market given the DOGE related firing. But for vast swaths of the US economy, the fact that mortgage rates have come down a bit has had a positive impact on refinancing as well as an outright housing purchase decisions. So I am not in the recession camp,” Taimur Baig, Managing Director & Chief Economist, DBS Group told CNBC-TV18 on March 26. Image: U.S. dollar banknote and a label with the word “Recession” are seen in this illustration taken March 19, 2025. REUTERS/Dado Ruvic/Illustration

[ad_2]

Source link