[ad_1]

The stocks included in the F&O segment are also among those that one of the fit the criteria to get included in the Nifty 50 index. In this case, Zomato has now become a contender to be included in Nifty50 also. BSE has also announced that Zomato will be included in the benchmark index Sensex from December 23. Brokerage firm JM Financial is of the view that Zomato could join the Nifty 50 in the rebalancing to be held in March 2025.

Despite the downtrend in today’s session, brokerage firm Jefferies has maintained its bullish stance following the launch of Zomato’s District app, which it sees as an “opportunity.”

According to Jefferies, Zomato shares have the potential to rise 17% more from the closing price of November 28, which has set a target price of ₹335.

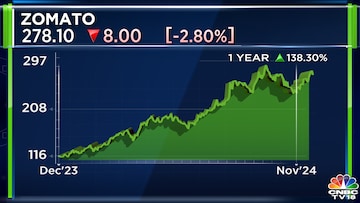

In the past year, Zomato shares have given a return of more than 140% to its investors, as against benchmark Nifty 50 which has risen 20% during the period.

In its brokerage note, Jefferies stated that Zomato has unveiled the ‘District’ app, which is a one-stop destination for going out. Starting with dining out and ticketing, the platform is expected to come up with new use cases.

The company’s management has said that the one-stop destination theme is for the next decade.

Jefferies is of the view that given that the market is supply-constrained it means an opportunity for Zomato to make the most of it.

Zomato launched the District app, a dedicated app for its growing going-out business, available on both iOS and Android on November 16. This makes it Zomato’s third consumer-facing venture after its flagship food delivery app and quick-commerce platform Blinkit.

The company has said that this new vertical will consolidate the “going-out” business, including dining, movies, sports ticketing, live performances, shopping, staycations, and more.

Initially, the app enables users to book tickets for movies and live events. Zomato’s Going-out business combines Dining-out and Zomato Live business verticals.

Earlier this week, Karan Taurani, Senior Vice President and Research Analyst at Elara Capital, also said that he expects Zomato’s quick commerce arm Blinkit to retain its leadership in the rapidly growing quick commerce market over the short to medium term.

While Swiggy Instamart and new entrants like Amazon India present competition, Taurani believes Blinkit’s robust strategy such as diverse stock-keeping units (SKUs) and dominance in key markets give it a significant edge.

Separately, Zomato also opened its ₹8,500 Qualified Institutions Placement (QIP) offering on November 25, with a floor price set at ₹265.91 per equity share. The indicative price was set at ₹252.62 per share, a 7.6% discount to Tuesday’s closing market price of ₹272.9 apiece. A total of 3.8% equity or 33.65 crore shares were on offer.

Track latest stock market updates on CNBCTV18.com’s blog here

[ad_2]

Source link