This is the market Ben Inker has been waiting for. In the grip of Wall Street’s rebellion against President Donald Trump’s tariff agenda – with stocks down around 2% this week even after Friday’s big rebound – Inker is among a cohort of investors making money in this year’s volatility spiral. The long-time skeptic of […]

Macquarie Capital says India’s FY25 earnings growth may be slower than market expectations – CNBC TV18

Viktor Shvets, Head of Global Desk Strategy at Macquarie Capital, believes India’s earnings per share (EPS) for the financial year ending in March 2025 will be around 11%-13%, lower than market estimates of 16%-18%. Company Value Change %Change Shvets expects the US dollar to start the year much stronger, but weaken by the year-end. Although […]

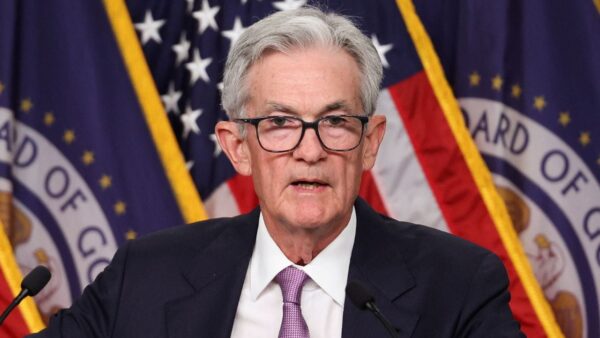

US stocks fall as Federal Reserve keeps interest rates unchanged – CNBC TV18

US stocks dropped on Wednesday, January 29, after the Federal Reserve kept interest rates unchanged in its first policy decision of 2025. The S&P 500 traded 0.8% lower, while the tech-heavy Nasdaq Composite more than lost 1%. The Dow Jones Industrial Average (DJIA) shed 179 points, or 0.4%. Company Value Change %Change The Federal Reserve […]

US Fed Meeting LIVE Updates: All eyes on Jerome Powell as FOMC set to announce its rate cut decision tonight

US Fed Meeting LIVE Updates: The US Federal Reserve is set to announce its first monetary policy decision of 2025 on Wednesday (January 29) with expectations firmly pointing to an unchanged federal funds rate in the 4.25%-4.50% range. US Fed Meeting LIVE Updates: The US Federal Reserve is set to announce its first monetary policy […]

Too early to assess full impact of SEBI F&O rules, says BSE CEO – CNBC TV18

Sundararaman Ramamurthy, Managing Director and CEO of BSE discussed the effects of the Securities and Exchange Board of India’s (SEBI) new rules for futures and options (F&O) trading. He said the regulations are designed to protect the market and improve participation. While there has been a drop in notional volumes as expected, Ramamurthy stated that […]

US stocks end sharply higher, dollar drops after inflation report – CNBC TV18

Wall Street surged on Friday, December 20, and the dollar softened as cooler-than-expected inflation data helped investors look past the possibility of a government shutdown and fresh tariff threats from US President-elect Donald Trump. Company Value Change %Change All three major US stock indexes jumped more than 1%, gold surged and benchmark US Treasury yields […]

Ample room to boost investments in India and EMs, says Oppenheimer Asset Management – CNBC TV18

There is ample room for increased investment in India and other emerging markets (EMs), says John Stoltzfus, Chief Investment Strategist at Oppenheimer Asset Management, who sees opportunities for investors willing to navigate these markets. He said the US Federal Reserve’s recent 25 basis points (bps) rate cut fell short of market expectations. “Traders wanted more […]

Barclays strategist sees rupee at 87 per dollar by end-2025, but outperforming Asian peers – CNBC TV18

Mitul Kotecha, Head of FX and EM Macro Strategy Asia at Barclays, said the rupee is likely to weaken further, reaching 87 against the dollar by the end of next year, despite temporary measures to slow its fall. However, it is expected to continue outperforming its Asian peers. Kotecha highlighted that the rupee is overvalued […]

Federal Reserve cuts interest rates by another 25 basis points; US markets in the red – CNBC TV18

Federal Reserve interest rate decision news: The Federal Reserve reduced its key interest rate by 25 basis points on Wednesday, December 18, 2024, marking the third consecutive cut. As expected by the markets, the Federal Open Market Committee (FOMC) lowered the overnight borrowing rate to a target range of 4.25%-4.5%. This brings rates back to levels […]

US Fed meeting LIVE updates: Will the US central bank opt for a 25 or 50 bps rate cut?

US Fed Meeting LIVE Updates: The US Federal Reserve is expected to lower its benchmark interest rate by 25 basis points at the conclusion of its two-day meeting on December 18. This would mark the third consecutive rate cut, bringing the federal funds rate to a target range of 4.25%-4.5% from the current 4.5%-4.75%. US […]