[ad_1]

1 / 12

1 / 12PNB Housing Finance | Mortgage lender reported a 36% year-on-year (YoY) surge in net profit at ₹471.4 crore for the third quarter that ended December 31, 2024. In the corresponding quarter of the previous fiscal, PNB Housing Finance posted a net profit of ₹346.5 crore. Net interest income (NII), which is the difference between the interest income a bank earns from its lending activities and the interest it pays to depositors, increased 15%, coming at ₹1,119 crore against ₹989.1 crore in the corresponding quarter of FY24.

2 / 12

2 / 12ICICI Prudential Life | The company reported a 43% surge in net profit of ₹326 crore for the third quarter ended December 2024. The life insurance company promoted by ICICI Bank had posted a profit of ₹227 crore in the same quarter a year ago. During the third quarter of the ongoing fiscal year, the net premium income increased to ₹12,261 crore, as against ₹9,929 crore a year ago, ICICI Prudential Life said in a regulatory filing.

3 / 12

3 / 12Tata Technologies | Global engineering and product development digital services firm reported a 1% year-on-year (YoY) dip in net profit at ₹168.6 crore for the third quarter that ended December 31, 2024, against ₹170.2 crore in the year-ago period. The company’s revenue from operations increased 2.2% to ₹1317.4 crore compared to ₹1,289.5 crore in the corresponding period of the preceding fiscal.

4 / 12

4 / 12KEI Industries | Cable maker reported a 9.4% year-on-year (YoY) increase in net profit at ₹164.8 crore for the third quarter that ended December 31, 2024. In the corresponding quarter of the previous fiscal, KEI Industries posted a net profit of ₹150.6 crore. The company’s revenue from operations rose 19.8% to ₹2,467.2 crore against ₹2,059.3 crore in the year-ago quarter.

5 / 12

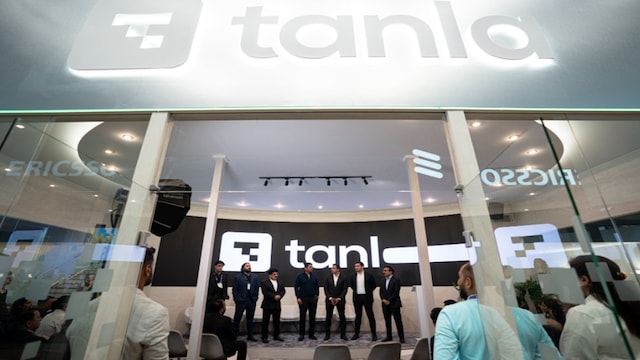

5 / 12Tanla Platforms | The company reported a 15.4% year-on-year (YoY) decline in net profit at ₹118.5 crore for the third quarter that ended December 31, 2024. In the corresponding quarter of the previous fiscal, Tanla Platforms posted a net profit of ₹140.1 crore. The company’s revenue from operations dipped 0.2% to ₹1,000.4 crore against ₹1,002.6 crore in the year-ago quarter.

6 / 12

6 / 12Dalmia Bharat | Cement maker reported a 75.2% year-on-year (YoY) decline in net profit at ₹66 crore for the third quarter that ended on December 31, 2024. In the same quarter in FY24, Dalmia Bharat posted a net profit of ₹266 crore. The CNBC-TV18 poll had predicted a profit of ₹138 crore for the quarter under review. The company’s revenue from operations dipped 11.7% to ₹3,181 crore against ₹3,604 crore in the corresponding period of the preceding fiscal. The CNBC-TV18 poll had predicted revenue of ₹3,375 crore for the quarter under review.

7 / 12

7 / 12Indiamart Intermesh | B2B e-commerce firm reported a 47.6% year-on-year (YoY) jump in net profit at ₹121 crore for the third quarter that ended December 31, 2024. In the corresponding quarter of the previous fiscal, Indiamart Intermesh posted a net profit of ₹82 crore, the company said in a regulatory filing. The company’s revenue from operations increased 16% to ₹354.3 crore as against ₹305.3 crore in the corresponding period of the preceding fiscal.

8 / 12

8 / 12Jana Small Finance Bank | The bank reported a 17.8% year-on-year (YoY) decline in net profit at ₹110.6 crore for the third quarter that ended December 31, 2024. In the corresponding quarter of the previous fiscal, Jana Small Finance Bank posted a net profit of ₹134.6 crore. However, there was a rise in the net interest income (NII), which is the difference between the interest income a bank earns from its lending activities and the interest it pays to depositors.

9 / 12

9 / 12India Cements | The Chennai-based cement manufacturer recorded a net loss of ₹428.8 crore for the third quarter of fiscal 2025 (FY25), a significant increase from a loss of ₹16.5 crore in the same period last year. Revenue for the quarter declined by 17% to ₹903.2 crore, compared to ₹1,082 crore in Q3 FY24. The cement maker also reported an exceptional loss of ₹190 crore in Q3, which contributed to the wider loss. The decline in revenue and the exceptional loss highlight ongoing challenges for the company amid a sluggish demand environment.

10 / 12

10 / 12Cyient DLM | Electronic manufacturing services firm Cyient DLM Ltd on Tuesday (January 21) reported a 40.8% year-on-year (YoY) fall in net profit at ₹10.9 crore for the third quarter that ended December 31, 2024. In the corresponding quarter of the previous fiscal, Cyient DLM posted a net profit of ₹18.4 crore. The company’s revenue from operations surged 38.4% YoY to ₹444.2 crore over ₹321 crore in Q3 FY24.

11 / 12

11 / 12Neuland Labs | Drug firm announced that its board of directors approved capital expenditures totalling ₹342 crore for capacity expansion at its facilities in Telangana. At unit 1 in Bonthapally, the company plans to increase its peptide synthesiser capacity from 0.5 KL to 6.37 KL. The expansion, requiring an investment of ₹254 crore, is expected to be completed by FY27. At unit 3 in Gaddapotharam, the company will increase its capacity from 321 KL to 373 KL, with an investment of ₹88 crore (inclusive of GST).

12 / 12

12 / 12Rossari Biotech | Specialty chemicals manufacturer reported a 7.6% year-on-year (YoY) decline in net profit at ₹31.7 crore for the third quarter that ended December 31, 2024. The company posted a net profit of ₹34.3 crore in Q3 FY24. Rossari’s revenue from operations increased 10.6% to ₹512.7 crore against ₹463.7 crore in the corresponding period of the preceding fiscal. At the operating level, EBITDA was up 1.9% to ₹64.7 crore in the third quarter of this fiscal over ₹63.5 crore in the year-ago quarter.

[ad_2]

Source link