[ad_1]

Index Fund Corner

Sponsored

| Scheme Name | 1-Year Return | Invest Now | Fund Category | Expense Ratio |

|---|---|---|---|---|

| Axis Nifty 50 Index Fund | +32.80% | Invest Now | Equity: Large Cap | 0.12% |

| Axis Nifty 100 Index Fund | +38.59% | Invest Now | Equity: Large Cap | 0.21% |

| Axis Nifty Next 50 Index Fund | +71.83% | Invest Now | Equity: Large Cap | 0.25% |

| Axis Nifty 500 Index Fund | — | Invest Now | Equity: Flexi Cap | 0.10% |

| Axis Nifty Midcap 50 Index Fund | +46.03% | Invest Now | Equity: Mid Cap | 0.28% |

Here’s a breakdown of the important tax changes you need to be aware of:

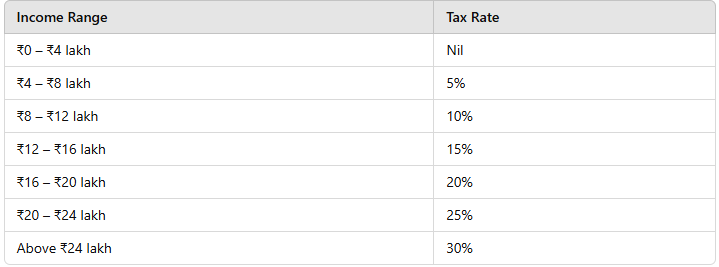

New income tax slabs under the new tax regime

The new tax regime introduces updated income tax slabs, providing some relief to taxpayers.

Here’s a quick look at the new slabs:

Additionally, the tax exemption slab has been increased from ₹7 lakh to ₹12 lakh, thanks to a tax rebate available under Section 87A.

Higher deductions for senior citizens

Senior citizens stand to benefit from an increase in the interest deduction limit, which has been raised from ₹50,000 to ₹1 lakh.

Moreover, the tax deduction limit on rent has been increased from ₹2.40 lakh to ₹6 lakh per year.

Increased TCS exemption limit

The exemption limit for Tax Collected at Source (TCS) on Liberalised Remittance Scheme (LRS) transactions has been raised from ₹7 lakh to ₹10 lakh. This change aims to reduce the tax burden on overseas remittances.

Rationalisation of TDS rates and thresholds

Several TDS provisions have been revised, including a reduction in the TDS rate for Section 194LBC, which applies to income from securitisation trusts. The TDS rate will now be 10% instead of the previous 25% for individuals and 30% for others.

Additionally, the government has increased the thresholds for TDS applicability under sections 193, 194A, 194B, 194BB, 194D, 194G, 194H, 194-I, 194J, and 194LA. This will help taxpayers keep more of their income.

End of higher TDS/TCS for non-filers

From April 1, 2025, the government has removed the provisions for higher TDS/TCS on non-filers of income tax returns. If you have not filed your ITR in the specified years, you will no longer face higher tax deductions or collections from this date.

New deduction for NPS Vatsalya contributions

The NPS Vatsalya contributions can now be claimed under Section 80CCD, but this deduction is only available to individuals opting for the old tax regime.

Simplification of self-occupied property valuation

The calculation of the annual value of a self-occupied property has been simplified. Taxpayers can now determine the value of their property for income tax purposes.

Under the new guidelines, the annual value of any two self-occupied houses can be considered zero.

[ad_2]

Source link