[ad_1]

SUMMARY

The Income Tax Department in India offers two types of tax regimes: the new tax regime and the old tax regime. The new tax regime, introduced in 2020, provides lower tax rates but eliminates most exemptions and deductions, such as those for home loan interest and tax-saving investments. On the other hand, the old tax regime allows taxpayers to avail of various exemptions and deductions, but with higher tax rates.

1 / 7

1 / 7In India, the Income Tax system is based on structured tax slabs, where different income ranges are taxed at varying rates to ensure higher earners contribute more. Salaried employees can choose between two tax regimes: the old and the new.

2 / 7

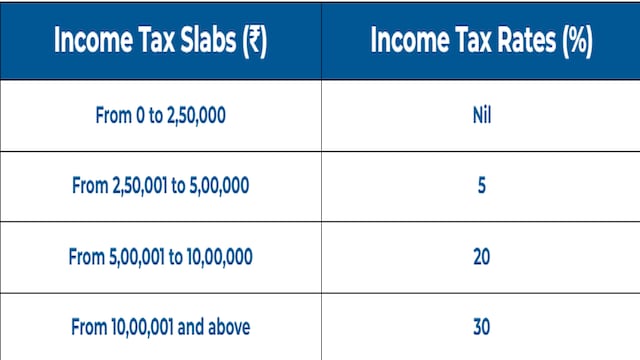

2 / 7The old tax regime slab is as shown above, with several exemptions and deductions available.

3 / 7

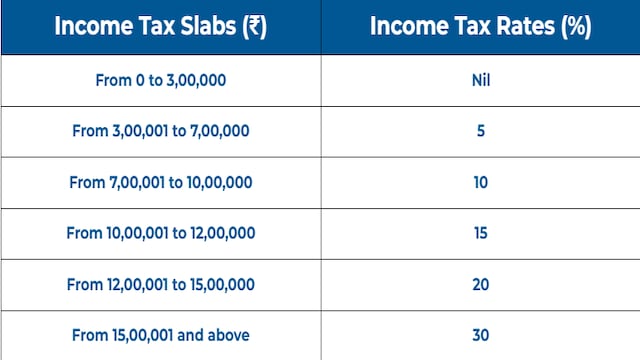

3 / 7The new tax regime slab follows the structure shown above. The tax rates are lower but there are also fewer deductions and exemptions available.

4 / 7

4 / 7Under the old tax regime, tax rates are higher but there are several exemptions and deductions available. It includes tax slabs ranging from 2.5% to 30% based on income. But under the new tax regime, tax rates are lower, with slabs starting from 0% to 30%, but there are fewer deductions and exemptions available.

5 / 7

5 / 7The old tax regime encourages savings by offering various deductions and exemptions, such as those under Section 80TTB, which benefit senior citizens. In contrast, the new tax regime simplifies the tax filing process with lower tax rates, particularly benefiting individuals in lower-income slabs, though it offers fewer deductions and exemptions.

6 / 7

6 / 7According to the Income Tax Department, “The option to choose between two regimes may vary from person to person. It is advisable to do a comparative evaluation and analysis under both regimes and then choose as per requirement. Taxpayers can broadly estimate and compare tax liability under the new and the old tax regime using the Income and Tax Calculator on the Income Tax Portal.”

7 / 7

7 / 7It is often advised to take the help of tax experts before opting for one of the two options available. It is crucial to inform the employer of your chosen tax regime to make sure that the correct tax is deducted at source — TDS — from your salary.

[ad_2]

Source link