[ad_1]

This change is expected to boost disposable income, increase savings, and stimulate household consumption.

Key highlights of the new tax slabs:

Taxpayers earning up to ₹12 lakh will now be exempt from income tax. For salaried individuals with a standard deduction of ₹75,000, the taxable income threshold extends to ₹12.75 lakh.

This is a significant change from the earlier ₹7 lakh limit, allowing more taxpayers to retain their full income.

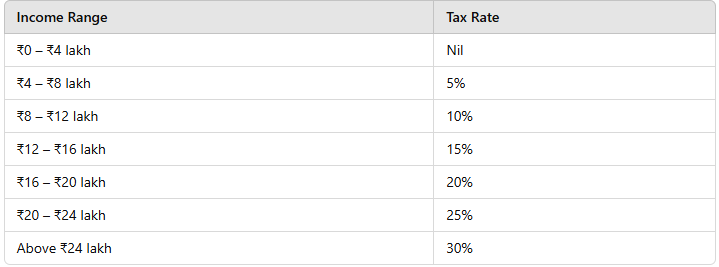

The new tax regime includes changes in rates for various income brackets.

The revised tax structure will be as follows:

The government believes that the new structure will substantially reduce taxes for the middle class, leaving more money in their hands to boost household savings, consumption, and investments.

Kumarmanglam Vijay, Partner, JSA Advocates & Solicitors around Income Tax, said, “Zero tax up to ₹12 lakh is expected to be transformative and will provide some relief to the middle class, that was observing this closely given the current inflation.”

Adhil Shetty, CEO of BankBazaar.com, further explained the implications of the updated 30% tax slab, which now applies to incomes above ₹24 lakh, as opposed to the previous ₹15 lakh.

This change marks a 60% adjustment, making the system more equitable.

“Under the proposed 2025 tax regime, someone earning ₹25 lakh annually will pay ₹3.43 lakh in total tax, compared to ₹4.57 lakh under the 2024 regime. This translates to 5% more money in hand, or around ₹9,500 per month in savings — a substantial relief for taxpayers,” he said.

Tax rebate and benefits across income levels

The government has introduced an additional tax rebate to ensure that taxpayers earning up to ₹12 lakh (excluding special rate income such as capital gains) will pay no income tax. The total tax benefit of the revised slabs and rebate is significant at various income levels.

For instance:

A taxpayer with an income of ₹12 lakh will benefit by ₹80,000 in tax, reducing their total tax liability by 100% compared to existing rates.

A taxpayer with an income of ₹18 lakh will save ₹70,000, or 30% of their tax payable under the existing regime.

A taxpayer with an income of ₹25 lakh will receive a tax benefit of ₹1,10,000, or 25% of their current tax liability.

In addition to the income tax slab changes, senior citizens will get enhanced tax benefits. The deduction limit on interest income has been doubled from ₹50,000 to ₹1 lakh.

The government expects its revenue from income tax to increase 14.4% to ₹14.3 lakh crore in FY26, compared to the revised estimate of ₹12.5 lakh crore for financial year ending March 2025.

Catch all Budget related updates here

[ad_2]

Source link