[ad_1]

1 / 6

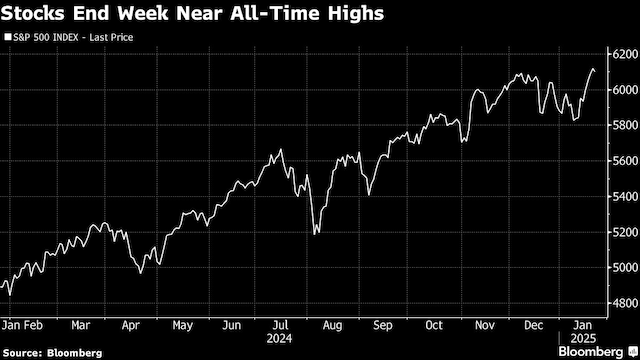

1 / 6On Friday, US benchmark stock index S&P500 slid from a record high it hit on Thursday but clocked its second straight weekly gain as global markets priced in near-certain interest rate cuts in February and lower odds of Donald Trump imposing tariffs on China. The gains stood at 1.7% for the week ended January 24, making it the best first after a President’s inauguration since 1985 when Ronald Reagan took over the Oval Office at the White House.

2 / 6

2 / 6The dollar wrapped up its worst week in 14 months as currency traders grapple with lots of tariff talk, with no real action, from President Donald Trump. “The dollar is rich, interest rates are high and both are ripe for a correction,” Matthew Hornbach, Morgan Stanley’s head of macro strategy, said Friday on Bloomberg Television. The CME Fedwatch Tool shows that markets are expecting a 99% chance of an interest rate cut by the US Federal Reserve in February 2025. The yield on 10-year Treasuries declined two basis points to 4.62%. The Bloomberg Dollar Spot Index fell 0.5%.

3 / 6

3 / 6Crude oil prices posted their first weekly decline this year after President Donald Trump threatened trade wars and demanded OPEC+ lower crude prices. West Texas Intermediate settled little changed above $74 a barrel. Earlier on Friday, crude extended losses after Russian President Vladimir Putin reiterated he’s open to discussing Ukraine and oil prices after Trump had threatened more penalties on Moscow if Putin doesn’t “make a deal” to end the prolonged war in Ukraine. In his speech at the World Economic Forum in Davos, Trump said Saudi Arabia bringing prices down would force Putin to withdraw from the Ukraine war.

4 / 6

4 / 6Six of the 11 S&P500 industry sectors rose, with utilities up 1.05% and leading gains. The sector’s biggest advancer, NextEra Energy Inc, rose about 6%, the S&P 500’s biggest gainer on the day. Tech was the biggest sector loser, down 1.33%, led by chipmaker Texas Instruments Inc which put out a disappointing forecast, which fell 7.1%. Meta Platforms Inc. climbed on plans to invest as much as $65 billion on AI projects in 2025. Cryptocurrency-linked firms rallied following Trump’s executive order favoring the industry. Nvidia Corp. led losses in big tech. Boeing shares fell 1.4% after the plane maker warned of another quarterly loss ahead of its earnings on Tuesday (Jan 28).

5 / 6

5 / 6Wall Street also waded through a slew of economic data on Friday, with the highlight being a drop in US consumer sentiment for the first time in six months. Consumers expect prices will climb at an annual rate of 3.2% over the next five to 10 years. They see costs rising 3.3% over the next year, the highest since May. Meanwhile, an S&P Global survey showed business activity slowing to a ninth-month low in January as prices rose. FILE PHOTO: REUTERS/Andrew Kelly/File Photo

6 / 6

6 / 6Investors are bracing for next week’s slew of key inflation and economic growth data as well as the Fed meeting, while waiting for policy updates from the Trump administration. Important corporate earnings next week include those from AT&T (Monday), Boeing and Starbucks (Tuesday), Tesla, Microsoft, Meta and IBM (Wed), Apple, Intel, Visa, and Blackstone (Thursday), Chevron and Exxon Mobil (Friday).

[ad_2]

Source link