[ad_1]

However, the groups stocks have rebounded since then and currently commands a valuation of ₹12.9 lakh crore. While the stock of Adani Power has more than doubled post the report, shares of Adani Ports and SEZ have gained 51% during the same period. Barring the two companies and Ambuja Cements, remaining group companies are still in the red.

Since October 2017, the short seller published reports on 63 companies. While stocks of most of these companies got battered after the reports, there are some outliers, with Adani Power being one of them.

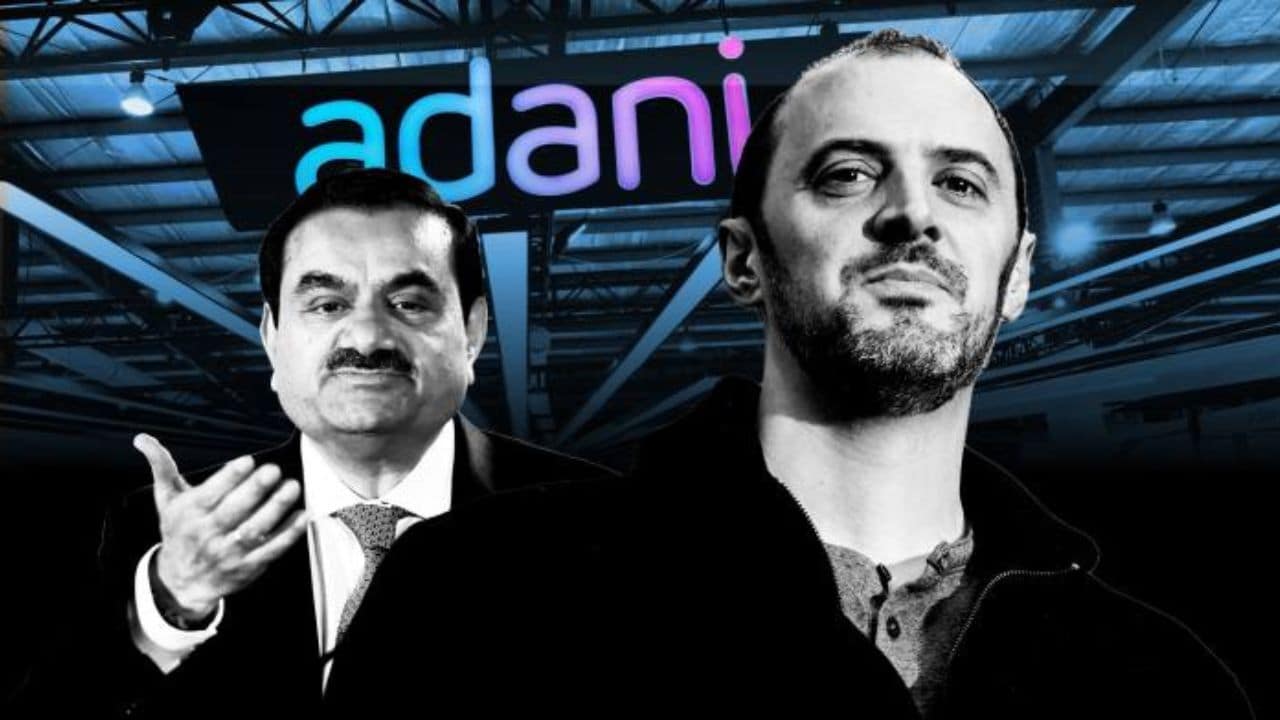

Also read | Short seller Nate Anderson says he’s disbanding Hindenburg

Of the total 63 companies, nine companies lost nearly 100% of their value, while 35 companies lost at least 50%. The market capitalisation of companies like Chicken Soup for the Soul Entertainment, Predictive Technology, SmileDirectClub, Sorrento and Tingo Group have been wiped out in their entirety post Hindenburg’s report on them.

Nevertheless, 12 companies that were targetted by the short seller have staged a smart come back with US-based Bloom Energy topping the list with a gain of 584%. Other gainers include diagnostic company Natera, which is up by 337%. Even health care service provider Davita and web application development company Opera have rallied 173% and 146% respectively.

Notably, three companies — software firm Ebix Inc, electric vehicle maker Lordstown Motors and Sorento Pharmaceuticals — have filed for bankruptcy.

After being active for seven years, Hindenburg on Wednesday (January 16) announced the closure of its business, which was launched in 2017. According to the research firm, the disbandment was a planned development following the completion of their investigative projects. “I have made the decision to disband Hindenburg Research. The plan has been to wind up after we finished the pipeline of ideas we were working on,” founder Nate Anderson wrote on the company’s website.

(Edited by : Jerome Anthony)

[ad_2]

Source link