[ad_1]

1 / 18

1 / 18US equity futures trade steady ahead of jobs report: U.S. stock futures were little changed Monday night as traders braced for a potentially tough month ahead after a strong but volatile August. US contracts edged lower this morning ahead of Wall Street reopening later Tuesday, following the Labor Day public holiday.

2 / 18

2 / 18Oil prices rise as Libyan crude exports remain halted: Oil dipped as concerns over China’s economic outlook offset supply disruptions from Libya following political unrest.Brent slipped toward $77 a barrel after closing 0.8% higher on Monday, and West Texas Intermediate was near $74. China’s growth engines are showing signs of sputtering, raising the prospect of urgent government stimulus. (Image: Shutterstock)

3 / 18

3 / 18Kamala Harris likely to bat for US Steel to remain domestically owned: Vice President Kamala Harris voiced her opposition to Nippon Steel’s pending purchase of U.S. Steel, adding another high-profile critic to the deal initially reached in December, according to a WSJ report. The Democratic presidential candidate visited Pittsburgh for the Labor Day holiday with President Biden, and both touted the administration’s accomplishments on behalf of union members and their families. At a campaign rally inside a union hall, Harris said that U.S. Steel should remain domestically owned and operated, mirroring the stance shared months earlier by the president. (Image: AP)

4 / 18

4 / 18Turkey formally seeks to join BRICS grouping: Turkey has formally asked to join the BRICS group of emerging-market nations as it seeks to bolster its global influence and forge new ties beyond its traditional Western allies, people familiar with the matter told Bloomberg. The view of President Recep Tayyip Erdogan’s administration is that the geopolitical center of gravity is shifting away from developed economies, according to the people, who spoke on condition of anonymity because they aren’t authorized to comment.

5 / 18

5 / 18Venezuela orders arrest of presidential candidate Edmundo after disputed election result: A Venezuelan judge on Monday issued an arrest warrant for the opposition’s former presidential candidate Edmundo González as part of a criminal investigation into the results of the highly anticipated July election that both the ruling party and its opponents claim to have won, AP reported.

6 / 18

6 / 18VW plans to shut down plants in Germany, even Goldman Sachs, Intel weigh cost cuts: Germany’s Volkswagen says auto industry headwinds mean it can’t rule out plant closings in its home country – and must drop a longstanding job protection pledge in force since 1994 that would have barred layoffs through 2029. “The European automotive industry is in a very demanding and serious situation,” Oliver Blume, Volkswagen Group CEO, said in a statement Monday. He cited new competitors entering the European markets, Germany’s deteriorating position as a manufacturing location and the need to “act decisively.”

7 / 18

7 / 18Huawei looks to upstage Apple with product launch just hours after iPhone16 unveil: Chinese tech giant Huawei reported hefty jumps in first-half revenue and net profit on Thursday, with smartphone sales robust and its smart car components business also doing well despite U.S. sanctions. Net profit for January to June climbed 18% to 54.9 billion yuan ($7.7 billion) on a 34.3% rise in revenue to 417.5 billion yuan. It was the company’s highest revenue for a first half since the same period in 2020.

8 / 18

8 / 18X blocked in Brazil after SC panel upholds suspension order: The Supreme Court confirmed an order to ban Elon Musk’s social network X in Brazil and fine those who don’t comply with it by using a virtual private network, or VPN. All five judges on the top court panel voted in favor of the decision to shut down the platform formerly known as Twitter during a virtual trial on Monday. X can still appeal the decision, after the conclusion of the hearing. (Image: Reuters)

9 / 18

9 / 18Stocks gain for the 13th session in a row, that’s the longest streak yet: In a 13-day gaining streak since August 14, the Nifty has rallied 4.72 per cent or nearly 1,140 points. Sensex has risen by 2.65 per cent or 2,135.16 points in its 10 straight days of gains.

10 / 18

10 / 18India may launch a sovereign wealth fund; talks on with SEBI, RBI: The Indian government is considering the possibility of establishing a global sovereign wealth fund, and officials have recently had preliminary discussions with the RBI, SEBI, and IFSC. Sources believe that an external fund could help India achieve deeper economic integration globally, with opportunities to invest in infrastructure, including housing and railway projects abroad.

11 / 18

11 / 18Cabinet clears 7 schemes with Rs 14000 cr outlay to boost agri sector: The Union Cabinet on Monday, September 2, approved around ₹14,000 crore outlay for seven big-ticket programmes related to the farming sector, including a ₹2,817-crore digital agriculture mission and a ₹3,979-crore scheme for crop science. (Image: Reuters)

12 / 18

12 / 18Supreme Court slams bulldozer demolitions, calls for all-India guidelines: The Supreme Court asked how can a anybody’s house be demolished because he is an accused. The top court decides to intervene on the issue of bulldozers deployed for demolition of property of accused persons. The court also said that it proposes to lay down guidelines on the issue. “We propose to lay down certain guidelines on a pan-India basis so that the concern with regard to the issues raised are taken care of,” the bench said. (Image: shutterstock)

13 / 18

13 / 18Congress claims SEBI Chair Madhabi Buch got income from ICICI Group, ICICI Bank says they are retiral benefits, earned ESOPs: ICICI Bank dismissed all allegations levelled by Congress against SEBI chairperson Madhabi Puri Buch, saying that neither the bank or its group companies paid any salary or granted any employee stock options plans (ESOPs) to her since her retirement. In a stock exchange filing, the private lender rejected all the charges levelled by Congress leader Pawan Khera. He had alleged that the Sebi chief earned Rs 16.8 crore from the ICICI group while holding her position as Sebi chair in a potential “conflict of interest”.

14 / 18

14 / 18SEBI member points to lack of checks and balances in SME segment, investor Vijay Kedia claims manipulation: Veteran investor Vijay Kedia believes that there is froth in many SME IPOs and that nine out of ten are being manipulated. He further stated that there is manipulation in both the SME (small and medium enterprises) board and the mainboard IPO segments.

15 / 18

15 / 18Cabinet clears Rs 26,000 cr aero engine order to HAL: The Cabinet Committee on Security has approved a ₹26,000 crore contract for Hindustan Aeronautics Ltd (HAL) to supply new AL-31FP engines for the Su30MKI fighter jets. HAL will manufacture 240 engines at its Koraput plant over eight years, with over 54% indigenous content.

16 / 18

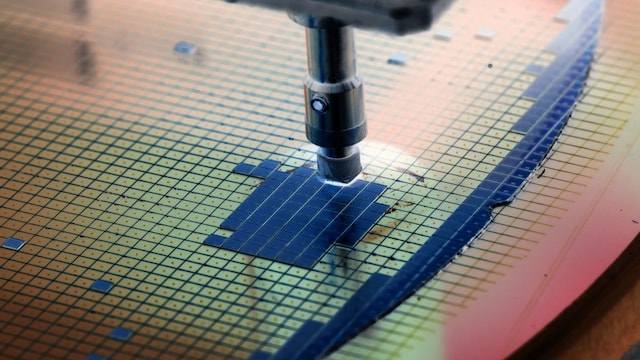

16 / 18Kaynes Tech gets Cabinet nod to set up Rs 3307 cr semicon unit at Sanand: Kaynes Semicon, a wholly-owned subsidiary of electronics manufacturing services (EMS) Kaynes Technology, on Monday received the Union Cabinet’s nod for its Rs 3,307 crore outsourced semiconductor assembly and test (OSAT) unit in Sanand, Gujarat. (Image: Shutterstock)

17 / 18

17 / 18Vedanta approves interim dividend of ₹20 / shr amounting to ₹7821 cr: “The Board of Directors of Vedanta Limited, at its meeting held today i.e. Monday, September 2, 2024, has considered and approved the third Interim Dividend of ₹20 per equity share on face value of Re 1 per equity share for the Financial Year 2024-25 amounting to ₹7,821 crore,” said Vedanta in a stock exchange filing.The record date for the purpose of payment of dividend shall be September 10, 2024.

18 / 18

18 / 18SEBI puts JSW Cement IPO on hold: The Securities and Exchange Board of India has temporarily halted JSW Cement’s proposed IPO valued at ₹4,000 crore. Intended for debt repayment and a new unit in Nagaur, the IPO combined share sales and fresh issues.

[ad_2]

Source link