[ad_1]

1 / 10

1 / 10Apple Inc., the manufacturer of iPhones, reported a revenue growth of 5% during the third quarter, beating Wall Street expectations. However, the stock was flat in extended trading amidst a market sell-off and issues with the company’s performance in China. More details here.

2 / 10

2 / 10The Bank of England cut interest rates for the first time since early 2020 and signalled further cautious reductions ahead, offering some relief to households after a year of the UK’s highest borrowing costs for a generation. Governor Andrew Bailey’s casting vote clinched the quarter-point drop in the benchmark to 5%. Details here.

3 / 10

3 / 10Intel Corp. plunged more than 19% after delivering a barrage of startling news, including a grim growth forecast and plans to slash 15,000 jobs, in the latest sign that the chipmaker is ill-equipped to compete in the artificial intelligence era. Sales for the current quarter will be $12.5 billion to $13.5 billion, the company said Thursday. Analysts had projected $14.38 billion on average, according to data compiled by Bloomberg. Intel will have a loss of 3 cents a share, excluding certain items, versus expectations for a profit 30 cents.

4 / 10

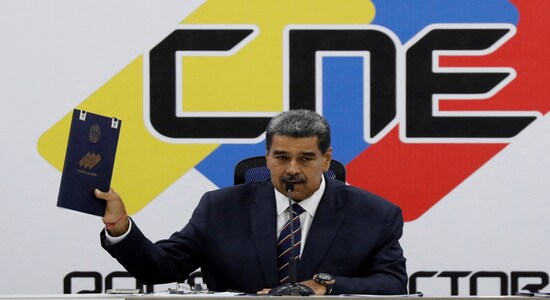

4 / 10The US government on Thursday recognised Venezuelan Opposition candidate Edmundo Gonzalez as the winner of the country’s presidential election, discrediting the results announced by electoral authorities, according to a CBS News report. The authorities had declared President Nicolas Maduro the winner.

5 / 10

5 / 10US markets on Wall Street ended sharply lower last night as investors fears of a recession resurfaced leading to worries that the US Federal Reserve may be too late to start cutting interest rates. The Dow Jones ended 500 points or 1.2% lower. At the lowest point of the day, the index was down 1.8%. The S&P 500 also shed 1.4%, while the Nasdaq fell over 2% to end just above the mark of 17,000. The Russell 2000, an outperformer recently fell 3%.

6 / 10

6 / 10Japanese stocks plunged for a second day as expectations rose on more rate hikes by the nation’s central bank. Asian equities also declined, tracking losses on Wall Street as data signaled a softening US economy. The Nikkei is trading with losses of over 5%.

7 / 10

7 / 10Possibly the most awaited IPO of the year, that of Ola Electric is set to open for subscription today. The bidding will remain open till August 6 for the ₹6,146 crore IPO. Price band for the same has been fixed at ₹72 – ₹76 per share. The company has already raised ₹2,763 crore from anchor investors ahead of the IPO. Here is a SWOT analysis from CNBC-TV18’s Meghna Sen.

8 / 10

8 / 10The Karnataka tax authorities have informed Infosys that the ₹32,400 tax demand notice issued to them has been withdrawn from their end and have directed the company to submit any further responses to the DGGI, the central authority. Nasscom has come out in support of Infosys, saying that the latest tax action reflected a lack of understanding of the operating business model.

9 / 10

9 / 10Continuing with growth momentum, the Goods and Services Tax (GST) collections for July grew by 10.3% at ₹1.82 lakh crore as against ₹1.74 lakh crore during the same month last year, according to the data released by the Union Finance Ministry. More on that here.

10 / 10

10 / 10The inevitable finally happened. After three days of teasing the landmark and making every market participant go into the “Will it? Won’t it?” mode, the Nifty finally scaled the mark of 25,000 on Thursday, thereby starting off the month of August on a positive note. However, the GIFT Nifty is indicating a gap down start considering the sell-off in the global markets.

[ad_2]

Source link