[ad_1]

The government expects its revenue from income tax to increase 14.4% to ₹14.3 lakh crore in FY26, compared to the revised estimate of ₹12.5 lakh crore for financial year ending March 2025.

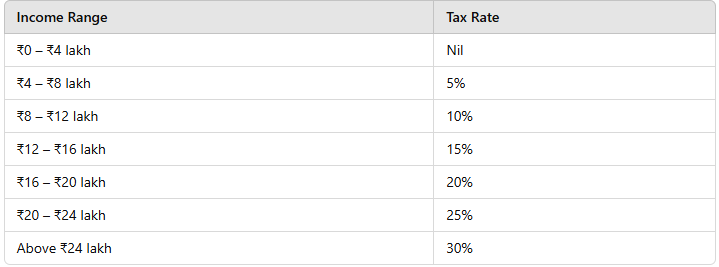

How the new income tax slabs work now?

- No tax on income up to ₹4 lakh.

- 5% tax on income from ₹4 lakh to ₹8 lakh.

- 10% tax on income from ₹8 lakh to ₹12 lakh.

For income beyond ₹12 lakh, higher tax rates apply:

- 15% tax on income from ₹12 lakh to ₹16 lakh.

- 20% tax on income from ₹16 lakh to ₹20 lakh.

- 25% tax on income from ₹20 lakh to ₹24 lakh.

- 30% tax on income above ₹24 lakh.

So, how is ₹12 lakh tax-free?

Under these rates, tax liability for an income of ₹12 lakh would be:

No tax on the first ₹4 lakh.

5% on ₹4 lakh to ₹8 lakh = ₹20,000.

10% on ₹8 lakh to ₹12 lakh = ₹40,000.

Total tax = ₹60,000.

However, with rebates and deductions, this tax is fully waived.

For salaried individuals with a standard deduction of ₹75,000, the taxable income threshold extends to ₹12.75 lakh.

Savings for higher incomes

A taxpayer earning ₹12 lakh saves ₹80,000, a 100% reduction in tax.

A person with ₹18 lakh income saves ₹70,000 (30% tax reduction).

A taxpayer earning ₹25 lakh benefits from a ₹1.1 lakh tax cut (25% reduction).

Notably, the old tax regime remains unchanged, with the basic exemption limit at ₹2.5 lakh.

Additionally, the government will introduce a new direct tax bill to simplify tax laws and reduce litigation. The Finance Minister assured that the new law would be clear, direct, and easier to understand.

These changes aim to put more money in taxpayers’ hands, encouraging spending and investment.

Catch all Budget related updates here

First Published: Feb 1, 2025 2:18 PM IST

[ad_2]

Source link