[ad_1]

SUMMARY

As Budget 2024 approaches, it’s important for consumers to be aware of the various taxes they pay on different transactions. Here is a ready reckoner on key taxes applicable in India, including Income Tax (IT), Securities Transaction Tax (STT), Capital Gains Tax (CGT), and Goods and Services Tax (GST).

1 / 6

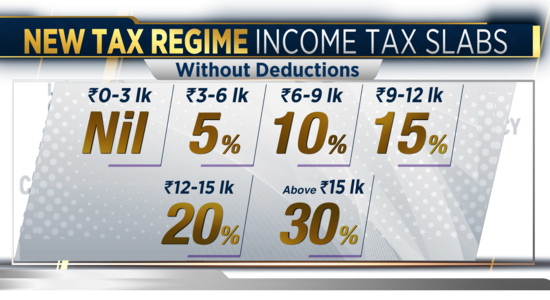

1 / 6Income Tax (I-T): Income tax is levied on individual earnings based on income slabs set by the government. Currently, there are two income tax regimes. Under the new regime, Individuals with an annual income of up to ₹3 lakh are not liable to pay any tax. A 5% tax rate is applicable for ₹3-6 lakh income, 10% for ₹6-9 lakh income, 15% for ₹9-12 lakh income, 20% for ₹12-15 lakh income, and 30% for income above ₹15 lakh.

2 / 6

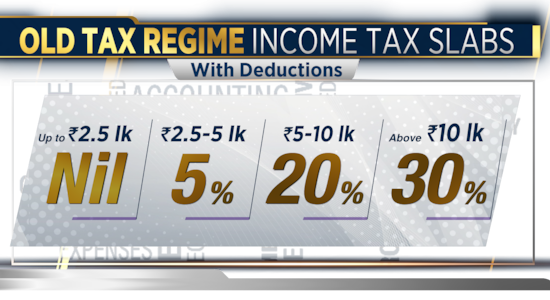

2 / 6Income tax: Under the old regime, individuals with a total income not exceeding ₹2.5 lakh are exempt from income tax. For income falling in the ₹2.5-5 lakh bracket, a 5% income tax is applicable. Those earning up to ₹5 lakh can claim a rebate of ₹12,500 under Section 87A of the Income Tax (I-T) Act. Individuals earning ₹5-10 lakh face a 20% tax rate. For total incomes exceeding ₹10 lakh, a 30% tax rate is applicable.

3 / 6

3 / 6Securities Transaction Tax (STT): STT is a tax levied on transactions done on the stock exchanges. The rates are as follows: Equity delivery: 0.1% on both buy and sell; Equity intraday: 0.025% on the sell side; Equity futures: 0.01% on the sell side; Equity options: 0.017% on the sell side (premium); Mutual fund units (equity-oriented): 0.001% on the sell side.

4 / 6

4 / 6Capital Gains Tax (CGT): Capital Gains Tax is charged on the profit from the sale of assets, classified into short-term and long-term, with rates varying accordingly. In India, short-term capital gains (on equities held for less than a year) are taxed at 15%, while long-term capital gains (on equities held for more than a year) exceeding ₹1 lakh are taxed at 10%.

5 / 6

5 / 6Goods and Services Tax (GST): GST is an indirect tax levied on the supply of goods and services. The primary GST slabs for any regular taxpayers are presently pegged at 0% (nil-rated), 5%, 12%, 18% & 28%. There are a few lesser-used GST rates such as 3% and 0.25%. Also, the composition taxable persons must pay GST at lower or nominal rates such as 1.5%, 5% or 6% on their turnover. There is a concept of TDS and TCS under GST as well, whose rates are 2% and 1%, respectively.

6 / 6

6 / 6Other taxes include excise duty which is levied on the manufacture of goods. It is currently applicable to petroleum and tobacco products. On the other hand, customs duty is imposed on goods imported into India. These rates vary based on product categories. Meanwhile, professional tax is levied by state governments on professions, trades, and employment, with rates varying across states but generally capped at ₹2,500 per annum.

[ad_2]

Source link