[ad_1]

Meanwhile, 75% of taxpayers have already shifted to the new tax regime, which has now been restructured to offer lower slab rates.

However, many taxpayers are confused about how much tax they will actually pay under the new tax regime announced in Budget 2025, especially if their income crosses ₹12 lakh per year.

Let’s break it down.

Understanding the new tax slabs

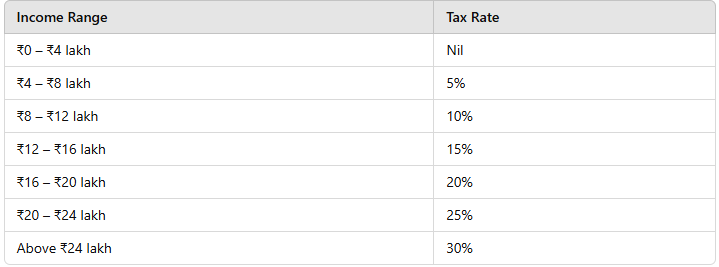

The government has introduced a new slab system, where tax is completely exempt for incomes up to ₹12 lakh.

However, the moment an individual’s taxable income crosses this threshold, they will have to pay tax on their entire taxable income as per the following rates: (Note: For salaried individuals, this limit increases to ₹12.75 lakh after factoring in the standard deduction of ₹75,000.)

This is a significant shift from the previous tax regime, where any income above ₹15 lakh was taxed at a flat 30% rate.

The revised tax brackets bring big savings for those earning between ₹12 lakh and ₹24 lakh.

How much tax will you pay? A breakdown based on different salaries

To better understand the impact of these changes, let’s look at how much tax you will pay at different income levels.

If your taxable income is ₹13 lakh

Since your income exceeds ₹12 lakh, the rebate does not apply. Here’s how your tax is calculated:

15% on ₹12-13 lakh → ₹15,000

So your total tax liability is ₹75,000 which was earlier ₹ 1 lakh—so you save ₹25,000 in taxes.

If your taxable income is ₹15 lakh

15% on ₹12-15 lakh → ₹45,000

Your total tax liability: ₹1,05,000

Earlier, this was ₹1.40 lakh—so you save ₹35,000.

If your taxable income is ₹20 lakh

20% on ₹16-20 lakh → ₹80,000

Your total tax liability: ₹2,00,000

Earlier, this was ₹2.90 lakh—so you save ₹90,000.

If your taxable income is ₹25 lakh

30% on ₹24-25 lakh → ₹30,000

Your total tax liability: ₹3,30,000

Earlier, this was ₹4.40 lakh—so you save ₹1.10 lakh.

Does the old tax regime still make sense?

For years, taxpayers preferred the old tax regime due to deductions like:

- Section 80C (₹1.5 lakh)

- HRA (House Rent Allowance)

- Home Loan Interest Deduction

- NPS Contributions

But with sharply reduced tax rates, even with deductions, the new regime is more beneficial for most taxpayers. This Budget sends a clear message: The new tax regime is the future, and for most taxpayers, it now makes more sense than the old system.

[ad_2]

Source link