1 / 15

1 / 15Brokerage firm BofA Securities has turned constructive on the Nifty 50 index, given that it is now trading at its long-term average valuation and on earnings growth estimates.

2 / 15

2 / 15The brokerage sees the Nifty 50 index at 25,000 by the end of the year, which implies a 14% potential upside of current levels. The Nifty has corrected 16% from its September 2024 high of 26,277.

3 / 15

3 / 15However, the brokerage remains bearish on Small and Midcap stocks. Based on this, it has recommended buying 12 largecap stocks, most of which are Nifty 50 constituents. These stocks have a potential upside of 10% to as high as 42%. Here is a look at these names:

4 / 15

4 / 15HDFC Life | BofA Securities has a price target of ₹875 on the insurance major, implying a potential upside of 42% from current levels. Diversification of distribution channels, opening of new branches, a balanced product mix and strong granular growth in tier-2 and tier-3 cities are some key tailwinds for the stock.

5 / 15

5 / 15Mahindra & Mahindra | Having corrected recently, BofA has a price target of ₹3,650 on M&M, which implies a potential upside of 40% from current levels. Like most others, BofA too called the pessimism surrounding Tesla’s potential India entry as exaggerated, adding that M&M’s luxury feature lineup is at the right price point. Tractor upcycle, SUV market share gains and EV strategy makes them confident of earnings delivery. The brokerage also likes the risk-reward at current levels.

6 / 15

6 / 15Bharti Airtel | BofA has a price target of ₹2,085 on the telecom services provider, implying a potential upside of 31%. The brokerage sees another round of tariff hikes in the next 12 months and even without that, it expects its Average Revenue Per User (ARPU) to improve by ₹2-₹3 per quarter led by feature phone users upgrading to smartphones and prepaid users moving to postpaid. Low capex guidance and improving EBITDA should improve free cash flow as well.

7 / 15

7 / 15L&T | BofA has a price target of ₹4,150 on the infrastructure and construction conglomerate, implying a potential upside of 30% from current levels. It said valuations are undemanding for order inflow / EPS CAGR of 12% and 22% respectively. Continued correction in crude oil prices though, could see a delay in orders or slower execution in the middle east business and remains a key downside risk. Potential of a share buyback remains an upside risk for L&T.

8 / 15

8 / 15Titan | BofA has a price target of ₹3,980 on the stock, meaning a potential upside of 29% from current levels. It expects healthy mid-to-high teens revenue and earnings growth and market share gains from Titan, looking beyond the volatility in gold prices for the very short term. Focus on gold exchange, golden harvest advance purchase schemes, wedding segment push will help the stock remain resilient amidst the consumption slowdown.

9 / 15

9 / 15Axis Bank | BofA has a price target of ₹1,300 on Axis Bank, which implies a potential upside of 29%. Axis is trading at 1.3 times price-to-book, which is attractive in historical context, according to BofA. Growth and NIM contraction risks are already priced in.

10 / 15

10 / 15Infosys | BofA has a price target of ₹2,150 on the stock which implies a potential upside of 26% from current levels. It expects Infosys to be a key beneficiary given its exposure to themes that will do well in a recovering demand environment like cloud, data and ERP. Stock is now trading at 23.5 times 12-months forward price-to-earnings, which is at a 5% discount to its five-year average trading multiple.

11 / 15

11 / 15Shriram Finance | BofA has a price target of ₹780 on the stock, implying a potential upside of 26% on the stock. Consistent delivery on asset quality metrics in comparison to peers, despite stress in certain vehicle finance segments at an industry level, consistent growth delivery, hopes of a better margin delivery with funding cost benefits and valuations at a significant discount versus peers are some key positives.

12 / 15

12 / 15ICICI Bank | BofA has a price target of ₹1,500 on the stock, which implies a potential upside of 24% from current levels. Better earnings visibility deserves a bigger premium versus peers, especially in the current macro environment, BofA said. It called ICICI one of the safest banks in terms of asset quality with no signs of stress and the highest provision buffer.

13 / 15

13 / 15Divis Laboratories | BofA has a price target of ₹6,850 on Divis, which implies a potential upside of 24% from current levels. The brokerage expects over 25% earnings growth over the next two years with a faster ramp-up of new capacity and GLP-1 being upside risks to their estimates.

14 / 15

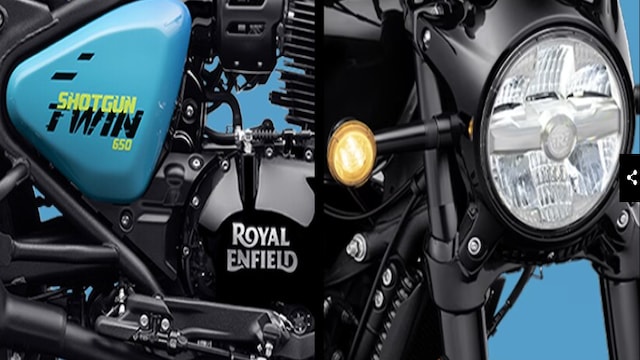

14 / 15Eicher Motors | BofA has a price target of ₹6,000 on the stock, implying a potential upside of 22% from current levels. It said Eicher is in a rare pocket of growth in a slowing two-wheeler market and it expects that to sustain. Earnings and valuations at 26 times financial year 2026 and 23 times financial year 2027 price-to-earnings should re-rate as delivery growth sustains, according to BofA.

15 / 15

15 / 15Bajaj Finance | BofA has a price target of ₹9,350, implying a potential upside of 9%, which is the lowest among the list of names recommended here. Strong track record of managing asset quality stress, industry leading growth with proactive pruning in high-risk segments, managing director’s intention to continue to contribute towards medium-term objections and re-acceleration in earnings growth, stable funding costs and credit costs peaking are some key triggers.